One simple way for multi-day travel operators and their partners to get paid — globally. TourRadar Payments manages customer bookings and payments end to end, automatically invoicing, splitting, and releasing funds for direct and partner bookings. With transparent fees, built-in compliance, and daily payment releases, operators gain predictable cash flow, less complexity, and more control.

More Bookings

Operators, Agents, Advisors and Hosts, give your customers globally more ways to pay to improve their booking journey

More Efficiency

Optimize your internal payment and invoicing capabilities using our comprehensive and secure global infrastructure

More Control

Improve your cash flow by controlling when to remit payment from your TourRadar Wallet

How it works

1. Customer payments are securely processed

2. Customer payments are held independently

3. Payments are split and released to you, and partners

4. You, and your partners control payment remittance

Flexible payment options for customers

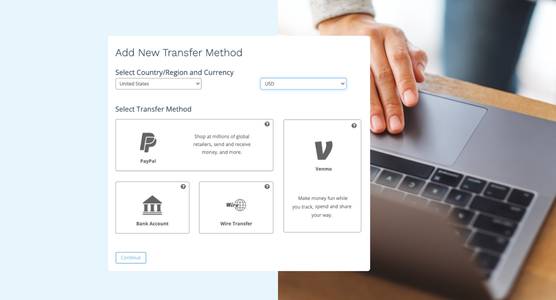

Payment methods

Customers can pay using Visa, Mastercard, American Express, Discover, PayPal, Apple Pay, Google Pay, and iDEAL. Based on their location, payments can be made in AUD, CAD, EUR, GBP, NZD, or USD.

Payment plans

At checkout, customers are shown payment plan options based on how close they are to the departure date. These may include, Paying a small deposit, with the balance due later; Paying in installments; or Paying in full at the time of booking.

All payment processing is fully automated and handled through TourRadar’s local entities in the United States, Canada, Australia, and Europe, ensuring high payment success rates, increased trust for customers in those regions, and no cross-border fees.

Fee structures simplified for operators

This single payment fee covers everything involved in getting paid — including payment processing, cross-border payments, operator payouts, and sales partner payouts — regardless of how the customer pays, which payment plan they choose, or which sales partner the booking comes from.

Our goal is to make payment costs simple, transparent, and predictable, so operators can confidently price it into their trips, without adding friction to the booking journey.

Trust and transparency for all

All of these capabilities are natively embedded in TourRadar Payments and are included in the payment fee outlined above.

Predictability and control for businesses

Funds can be remitted from the TourRadar Wallet to accounts in 200+ countries and regions across 50+ currencies, giving multi-day travel businesses the flexibility and control they need to manage cash flow globally.